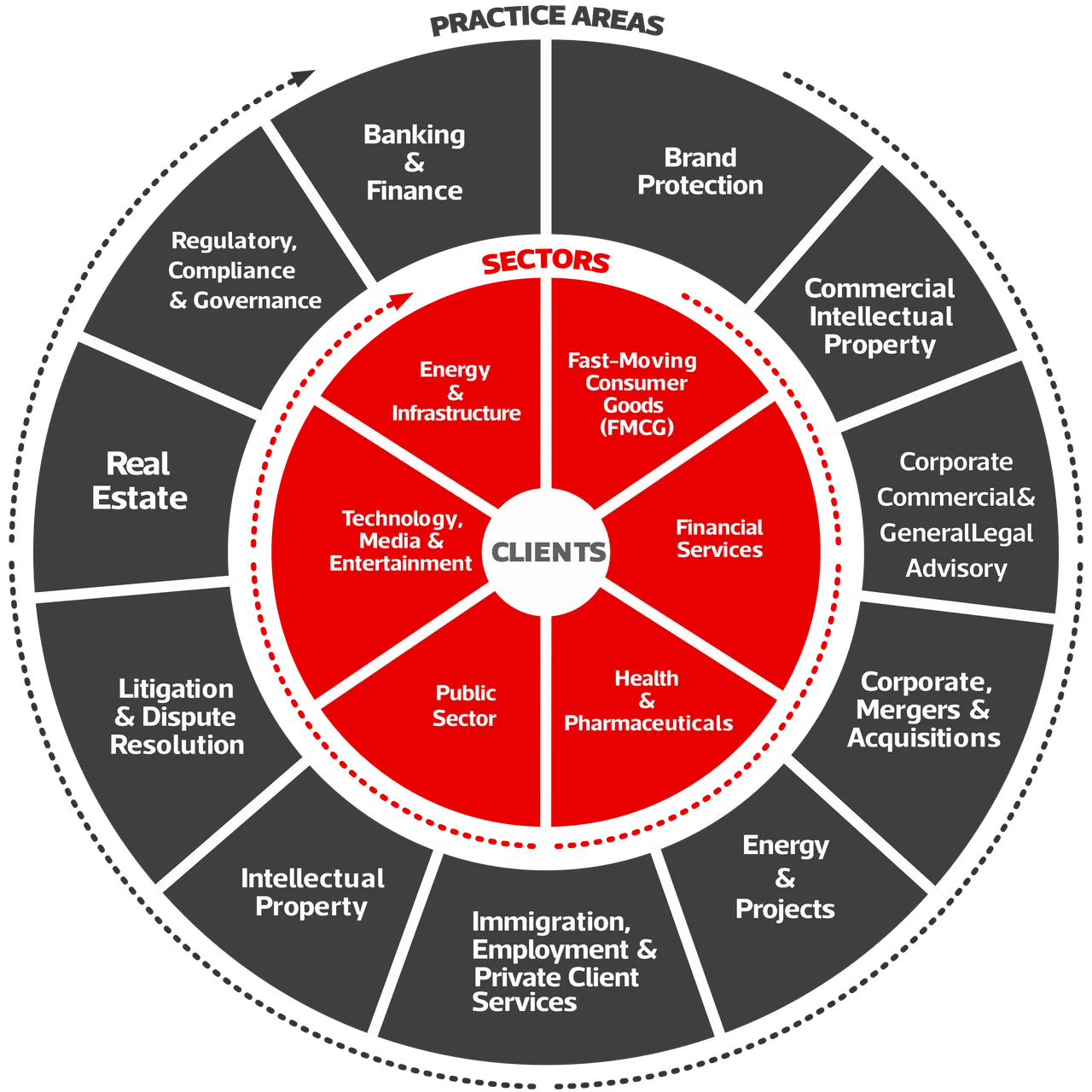

The Full-Service Law Firm with Sector Expertise

We deliver outstanding legal services, powered by our exceptional people and deep sector expertise. As a pan-African firm, our market is Africa, Our focus is always you.

Do more with Jackson, Etti & Edu (JEE)

Founded in 1996

70+

Lawyers

35

African Jurisdictions

6

Core Sectors

11

Practice Areas

Jackson, Etti & Edu is the first pan-African legal practice to offer clients a full-service law firm with sector expertise. Today, our team of 70+ lawyers works across 35 African legal Jurisdictions, 6 Core Sectors, and 11 Practice Areas in West, South, and Central & East Africa.

Within these sectors and practice areas, we offer services in Arbitration; Brand Protection; Commercial Intellectual Property & Data; Immigration, Employment & Private Client Services; Intellectual Property; and Regulatory & Compliance.

Award-winning Lawyers

Our highly sought-after lawyers know your business sector from the ground up and are highly recommended by leading independent legal directories, including Chambers Global, Who’s Who Legal, and The Legal 500 EMEA. Our lawyers regularly win industry awards and accolades, are asked to serve on the legal committees of regional and international governmental institutions, and are called upon to draft national legal frameworks. Recognized as one of Africa's foremost law firms.

Your Africa Business Partner

Our multi-sector representation has rewarded us with a globally diverse client base. We are proud to include local and international conglomerates; start-ups; mature companies; international institutions and agencies; and local and regional governmental organizations and local and international entrepreneurs; among our many long-term relationships.

Award-winning legal counsel to protect and grow your Africa business

Proudly Nigerian and resolutely pan-African, JEE has served the private and public sectors, global conglomerates, and celebrated entrepreneurs for nearly 30 years.

Headquartered in Nigeria with 6 strategically placed offices across Africa, our lawyers have the legal expertise, business acumen, and economic and geopolitical insights to guide you through business on the fastest-growing continent in the world.

Our clients think highly of us